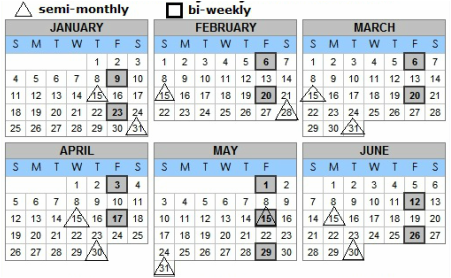

TODAY'S AGENDA: We are learning gross income and different pay periods: weekly,

bi-weekly, semi-monthly, and monthly.

|

1) Fill in the table below and complete page 21.

2) Using the calendar(s) below, figure out the total number for each pay period: weekly, bi-weekly, semi-monthly, and monthly. 3) Complete pages 22, 23, 24, and 25. |

1.3 Calculating Gross Income: |

Double click your name. By tabbing the space button, fill in your information.

|

GROSS PAY is an employee's total earnings ($) before any deductions are taken off.

DEDUCTIONS are costs such as income tax, EI (Employment Insurace), CPP (Canada Pension Plan) that are removed from total earnings.

Ex: Jacob makes $11 an hour and works for 20 hours a week. What is his gross pay for the week?

11 x 20 = $220

DEDUCTIONS are costs such as income tax, EI (Employment Insurace), CPP (Canada Pension Plan) that are removed from total earnings.

Ex: Jacob makes $11 an hour and works for 20 hours a week. What is his gross pay for the week?

11 x 20 = $220

Different pay periods

Using one of the calendars below, find the total number of pay periods.

WEEKLY BI-WEEKLY SEMI-MONTHLY MONTHLY

|

Annual salary divided by

|

Annual salary divided by

|

Annual salary divided by

|

Annual salary divided by

|

|

JANUARY

M T W Th Fr Sa Su 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 22 23 24 25 26 27 28 29 30 31 MAY

M T W Th Fr Sa Su 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 SEPTEMBER

M T W Th Fr Sa Su 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 |

FEBRUARY

M T W Th Fr Sa Su 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 JUNE

M T W Th Fr Sa Su 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 OCTOBER

M T W Th Fr Sa Su 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 |

|