3.1 AFTER-TAX COST: Pages 60 - 65

TODAY'S AGENDA: We are learning how to estimate and calculate after-tax cost.

|

1) Read the following information about GST/HST.

2) Watch the video. 3) Go through the page and complete pages 60, 61, 62, 63, 64, and 65. |

What is HST?

The Harmonized Sales Tax (HST) is a consumption tax in Canada. It is used in provinces where both the federal Goods and Services Tax (GST) and the regional Provincial Sales Tax (PST) have been combined into a single value added sales tax.

No GST/HST charged on the supply of the following goods and services:

|

|

Some supplies of goods and services are taxable at the rate of 0% (zero-rated). Meaning there is no tax on these supplies. Some common examples of zero-rated supplies of property and services are:

For more information, see Exempt supplies - List of GST/HST exempt supplies. |

You may need to estimate or calculate the after-tax cost of your purchase to ensure you have enough money.

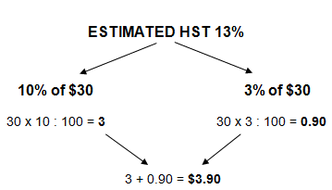

How do you estimate after-tax cost of a $28.99 backpack?

How do you calculate after-tax cost of a $150 purse?

Method 1: Use a tip calculator (app). Where it says bill, enter the tag price; where it reads tip, enter tax rate.

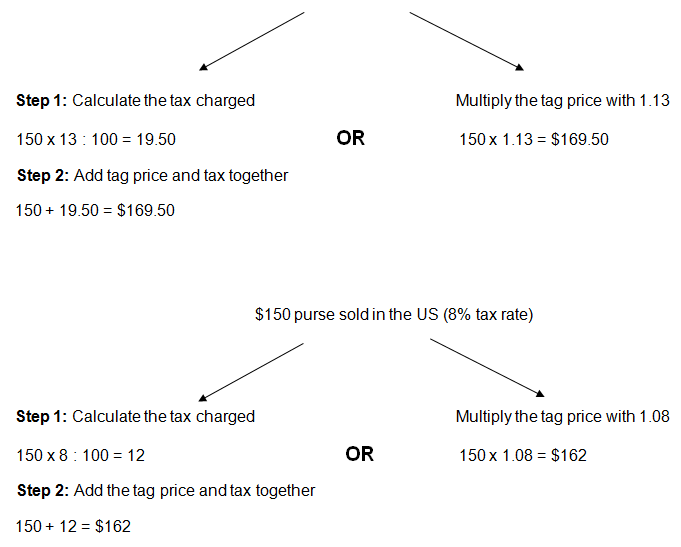

Method 2: Use a standard calculator. You can find the after-tax cost in 2 ways.

$150 purse sold in Ontario (13% tax rate)

$150 purse sold in Ontario (13% tax rate)