3.2 Incentives to Buy: Pages 66 - 73

TODAY'S AGENDA: We are learning incentives to buy.

|

1) Watch the video below.

2) Research some incentives online and upload on the padlet below. 3) Look at the examples below and complete pages 67, 68, 71, 72, and 73. |

A- Determining sale prices: Using a regular calculator

Method 1: You can determine sale prices by finding the percent remaining after the discount is taken.

Example

A purse that regularly sells for $149 is on sale today for 30% off of the regular price.

What is the sale price before tax?

Solution

The percent of the price that remains is 100% - 30% = 70%

You will only pay 70% of 149 which is 149 x 70 : 100 = $104.30

Regular Price Sale Price (30% off)

$149 $104.30

A purse that regularly sells for $149 is on sale today for 30% off of the regular price.

What is the sale price before tax?

Solution

The percent of the price that remains is 100% - 30% = 70%

You will only pay 70% of 149 which is 149 x 70 : 100 = $104.30

Regular Price Sale Price (30% off)

$149 $104.30

Method 2: You can determine sale prices by subtracting discount amount from the regular price.

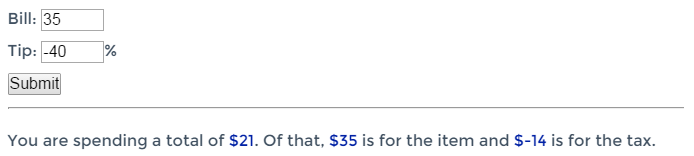

B - Determining sale prices: Using a tip calculator (app)

QUESTION

A pair of shoes that regularly sells for $129 is on sale today for 25% off of the regular price. What is the sale price before tax?

|

Tip Calculator

Bill: Tip: % |

1) What is the sale price before tax?

|

2) What is the sale price after tax?

|